REGULATION ON P2P LENDING

Peer to peer (P2P) lending or crowd sourcing for loans, are a recent innovation where fintech companies pool funds from individuals and lend it to businesses, disintermediating banks.. The government has notified the Reserve Bank of India as the regulator for peer to peer lending platforms that have been classified as Non Banking Finance Companies (NBFCs). While this could increase the costs for online lenders through compliance requirements, most have welcomed the move stating that it gives them recognition.

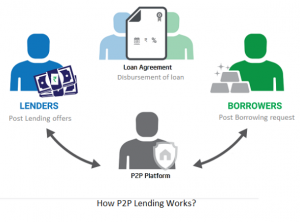

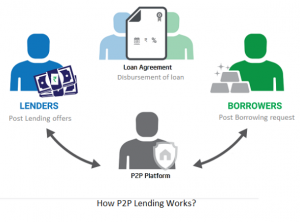

The P2P platforms, which do not take any credit risk on their own, use software and data analytics to gauge credit worthiness of borrowers. They are different from SEBI regulated collective investment schemes as the money raised is always in the form of debt. The P2P lenders have the potential to reach those borrowers which traditional lenders cannot trace. Also, these entities provide cheaper loans on the back of their lower operational costs. RBI regulations for lenders typically include capital requirements, exposure norms, income recognition norms and limits on borrowing.

Many view that the RBI regulation will bring a much needed legal clarity in the system and lenders/platforms will get legal rights to take adequate steps against defaulters. Also, regulation will mean wide acceptability of this concept among lenders as well as borrowers.

Thus, P2P lending will be an Influential force in India.

The P2P platforms, which do not take any credit risk on their own, use software and data analytics to gauge credit worthiness of borrowers. They are different from SEBI regulated collective investment schemes as the money raised is always in the form of debt. The P2P lenders have the potential to reach those borrowers which traditional lenders cannot trace. Also, these entities provide cheaper loans on the back of their lower operational costs. RBI regulations for lenders typically include capital requirements, exposure norms, income recognition norms and limits on borrowing.

Many view that the RBI regulation will bring a much needed legal clarity in the system and lenders/platforms will get legal rights to take adequate steps against defaulters. Also, regulation will mean wide acceptability of this concept among lenders as well as borrowers.

Thus, P2P lending will be an Influential force in India.

Comments

Post a Comment